SERAPAKINCIOGLU.COM | Free Printable 1099 Forms Irs Gov - Official copies can be ordered directly from the IRS If you are filing any of these forms 1097 BTC 1098 C 1098 MA 1098 Q 1099 CAP 1099 LTC 1099 Q 1099 QA 1099 SA 3922 5498 ESA 5498 QA and 5498 SA on paper due to a low volume of recipients fewer than 100 for these forms only you may file a black and white Copy A that you print

IRS Forms 1099 Are Key To Your Tax Filing Here s What To Know Forbes, How to request your 1099 R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099 R tile We ll send your tax form to the address we have on file You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab . Get your 1099 R tax form U S Office of Personnel Management, The IRS Free File program at IRS gov offers free tax software in 2025 to those with adjusted gross incomes of 84 000 or less Free File is already available online at IRS gov to use to prepare .

Free Printable 1099 Forms Irs Gov

Free IRS 1099 Form PDF eForms

The IRS Free File program at IRS gov offers free tax software in 2025 to those with adjusted gross incomes of 84 000 or less Free File is already available online at IRS gov to use to prepare .

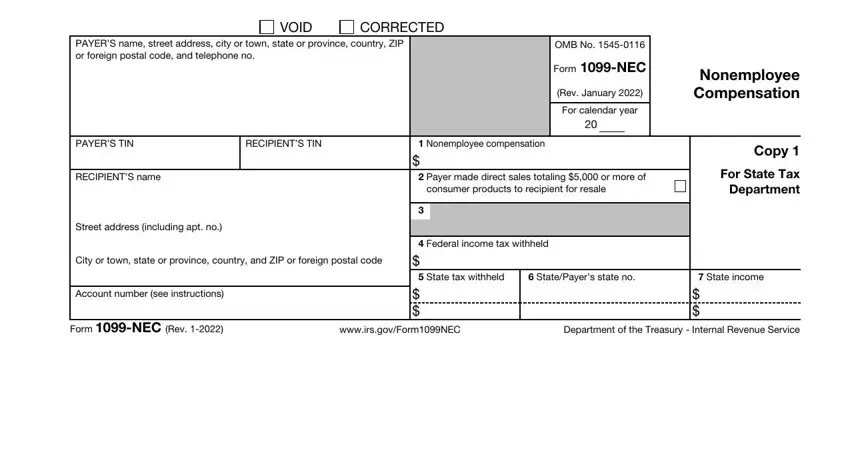

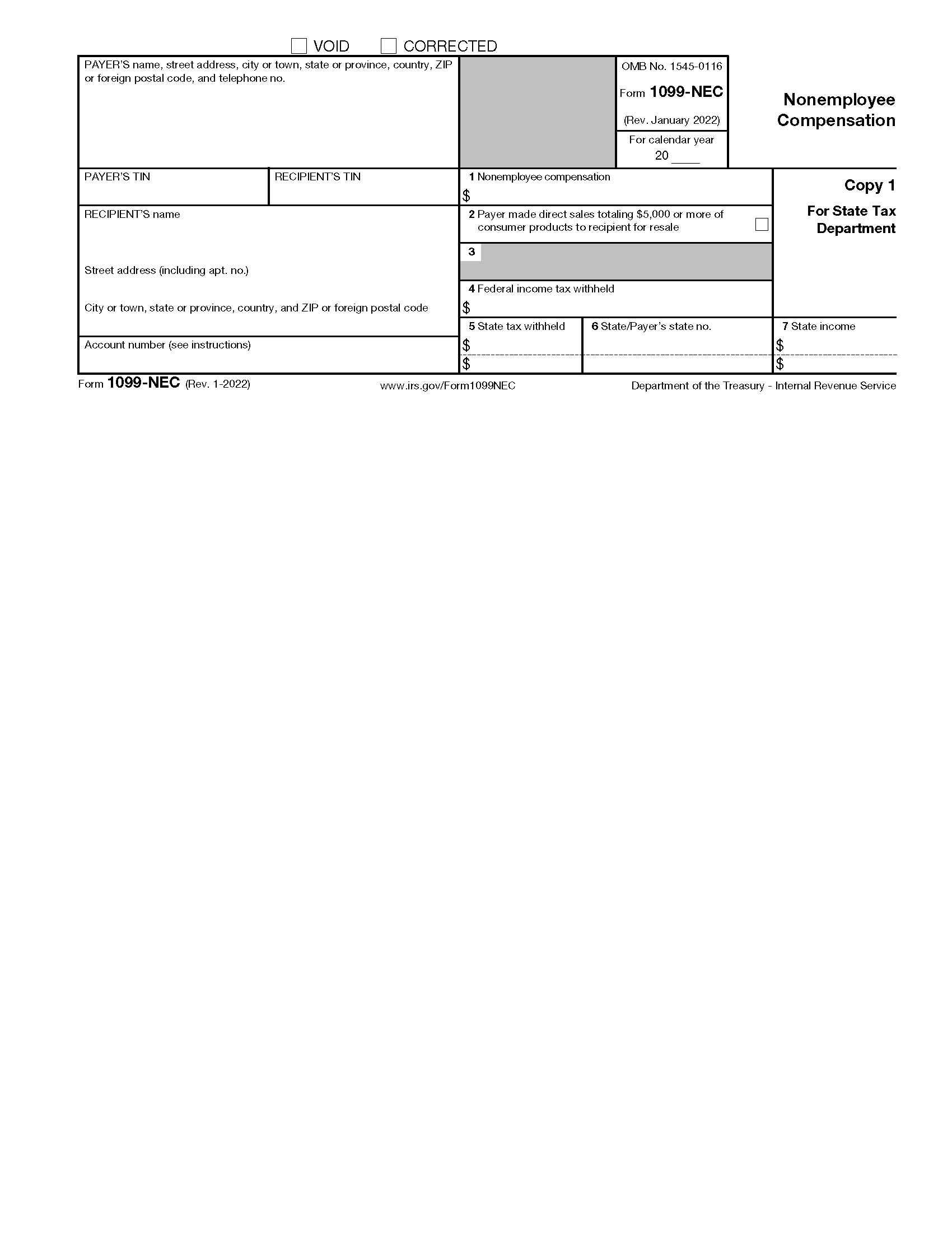

Free IRS 1099 NEC Form 2021 2024 PDF eForms

How to request your 1099 R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099 R tile We ll send your tax form to the address we have on file You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab .

span class result type PDF span Form 1099 NEC Rev January 2024 Internal Revenue Service

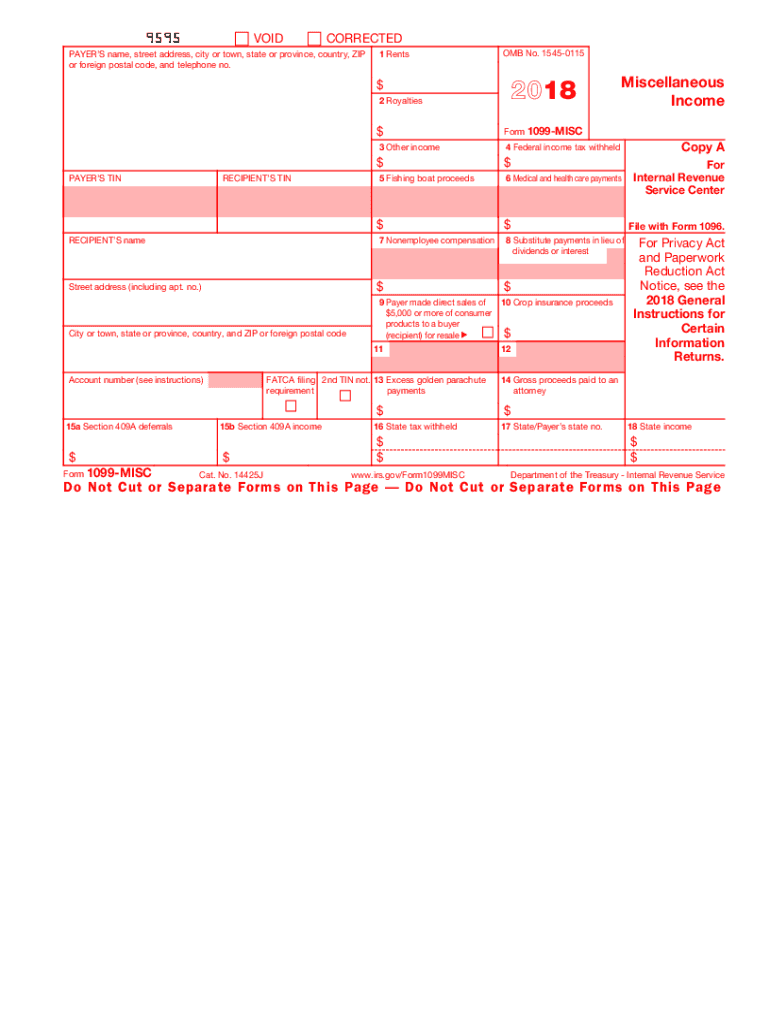

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately .

2024 tax returns How to file free what is 1099 K when W 2 s arrive

Official copies can be ordered directly from the IRS If you are filing any of these forms 1097 BTC 1098 C 1098 MA 1098 Q 1099 CAP 1099 LTC 1099 Q 1099 QA 1099 SA 3922 5498 ESA 5498 QA and 5498 SA on paper due to a low volume of recipients fewer than 100 for these forms only you may file a black and white Copy A that you print .

Free IRS Form 1099 MISC PDF eForms

Opinions expressed by Forbes Contributors are their own Robert W Wood is a tax lawyer focusing on taxes and litigation Closeup of Form 1099 NEC and 1099 MISC The IRS has reintroduced Form 1099 .

Get your 1099 R tax form U S Office of Personnel Management

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes .

Disclaimer: Content on this site is intended for educational, informational, and non-commercial purposes only. All trademarks, logos, and brands are the property of their respective owners. If you have any questions or concerns about rights or usage, feel free to reach out to us.

Top FAQs

1. Can I get printables for free?

Free printables include digital items like coloring sheets, study aids, and much more, all at no cost to you.

2. What can I find here?

Our printables range from calendars, activity worksheets, games, and much more!

3. How do I download a printable?

To download, simply click on the image or link, and it will open up. Then, right-click and select "Save As" to download it to your device.

4. What’s the resolution of the printables?

We provide printables in PNG and JPG formats, which are high-resolution for clear, crisp printing.

5. Can I use these for my business?

These printables are for personal use, and you must get permission for any commercial use, such as selling or distributing them.